Powerful Finance Tracking with Monarch Money

Plus real estate investment trusts (REITs), productivity tabs, and bite-sized courses

Disclaimer: This article contains affiliate links.

Hey folks! It’s been a while since I last posted on Substack. I’m looking to restart this project and stay consistent with it for the foreseeable future. Luckily, I’ve accumulated a huge list of applications and tools to recommend and review from the last several years. Let’s start with the three small mentions.

3 Honorable Mentions

Fundrise

Fundrise is an online investment platform with various real estate investment trusts (REITs), private funds, and even venture capital funds that users can invest in.

Investing in real estate can be cost-prohibitive for most average people. However, with Fundrise, you can start investing with as little as $10.

It’s hassle-free, requires no effort, and is ideal for people who want to set and forget. Rather than upfront fees, it functions like other mutual funds and deducts a tiny fraction of the portfolio as advisory fees.

I’ve been using Fundrise since 2017, and it’s one of the few investment platforms I trust. They are clear and transparent in their offerings and strategies, and at no point have they tried shilling any nonsense like NFTs, meme coins, or other sketchy investment vehicles. They also offer neutral and informative takes on current events and how they impact markets/real estate.

Start investing today and get $50. Disclaimer: I’m not a financial advisor. Remember that if you invest, you do so at your own risk.

Premium (no upfront payment)

Momentum Dash

Momentum Dash is a tab application that replaces your home tab in your web browser. There are plugins available for Chrome, Firefox, Edge, and Safari.

It’s highly customizable, with lots of great built-in features like task management, note taker, calendar, bookmarks, white noise, world clock, pomodoro, random motivational quotes, featured photography… the list of features keeps going.

Since 2017, this has been my choice of home tab, allowing me to stay focused, productive, and organized. My favorite features are the built-in pomodoro timer, the ability to save/favorite quotes or images, and the supported integration with Todoist (among many others). Any time I sit down and start work for the day, I open my laptop and pop open my Momentum Dash to get organized.

Freemium. Lots of features are free, but the paid plan (only $5/mo or $40/year) allows access to many extra features, including numerous integrations.

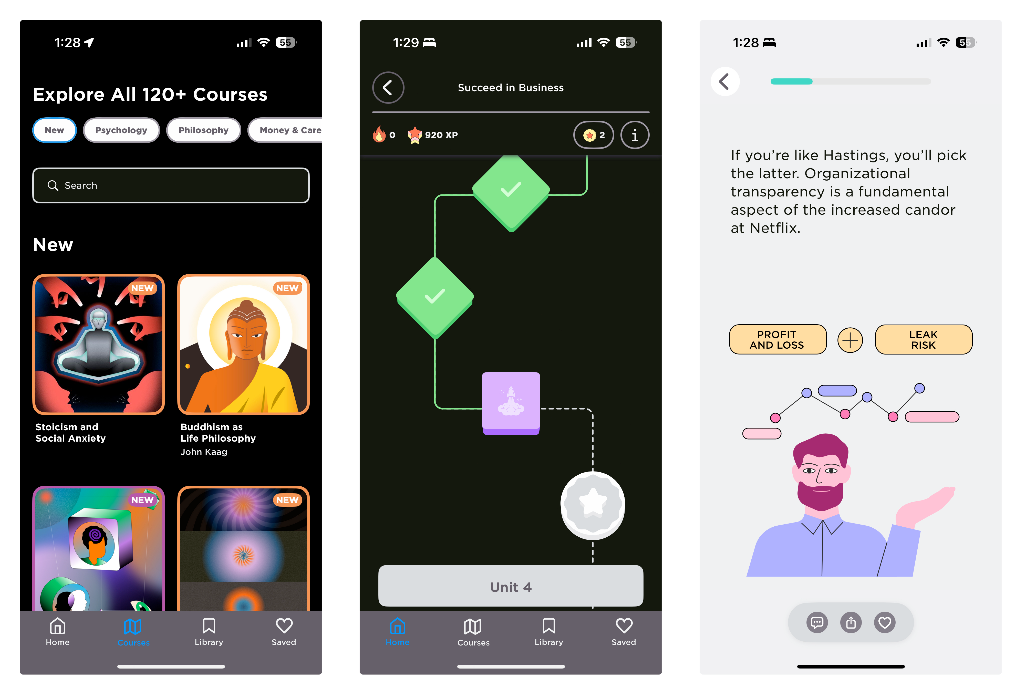

Imprint

Imprint is a learning app that visually presents courses and information to users in short, digestible bites.

It combines the best parts of online courses and book summarization (like Blinkist, Four Minute Books, etc.) to present you with valuable lessons and key points from books in a short-form format (like Instagram/Facebook stories).

For example, I’m partway through a Business Success course that has presented key learnings from Start With Why (Simon Sinek), The Lean Startup (Eric Ries), No Rules Rules (Reed Hastings), and more. Each lesson is only a few minutes, so you can take crank out some learning between breaks, while riding on transit, or any time you have an extra few minutes.

I’ve been using Imprint recently to curb my habit of doom-scrolling social media…

Premium ($100/year)

Each month, I cover three “honorable mentions” or fantastic apps that don’t necessarily require a full article review. Let’s talk about our main app now.

Monarch Money

It’s been just over a year since Intuit’s Mint unfortunately shut down. I don’t know how true this is, but the hearsay was that Mint was a money sink for Intuit while not returning or bringing in much revenue (it was free).

I’m not sure why they didn’t just start charging a subscription fee - a lot of people were pretty heavy users, and considering that all of the great budgeting tools charge a subscription fee anyway, I would have been happy to pay to use Mint.

But on the flipside, this ended up being a blessing in disguise, as the search for an alternative budgeting tool led me to Monarch Money.

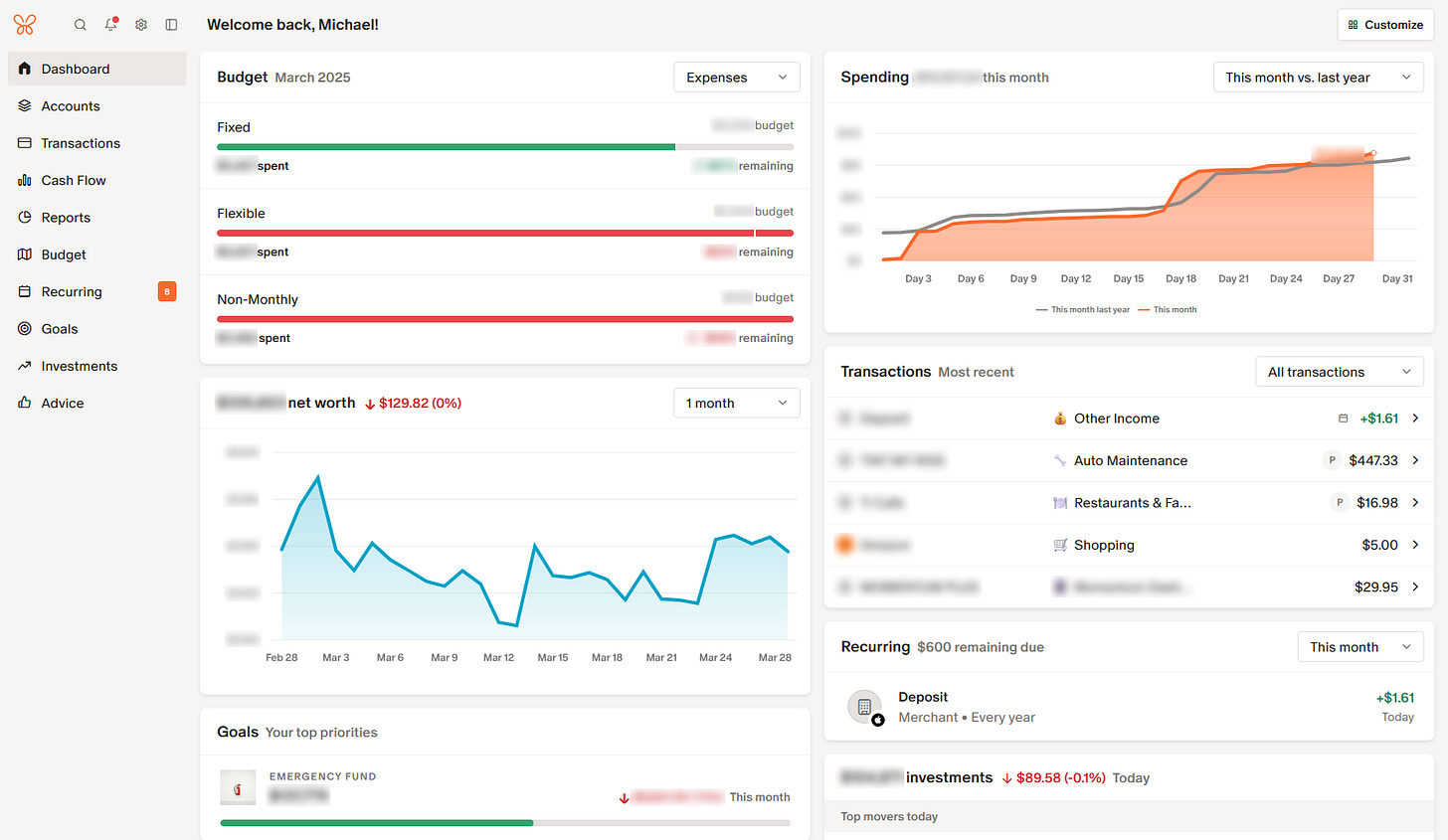

What Makes Monarch So Good

In short, I can summarize it in three primary bullets:

The interface is nice, and it’s easy to figure out. No documentation needed. It’s well put together, and if you grew up in the age of technology like me, it follows all of the UX patterns you would expect. Everything can be found by clicking around the application where you would expect to find things. I love easy-to-use apps.

Flexible/rollover budgeting, goals, and transaction categorization. It’s very flexible and holistic in how it’s used. Non-monthly transactions, flexible budget/spending, goals, and more, make this a perfect fit for my needs.

The underlying engine just works. One consistent complaint I had with Mint (and other budgeting apps I tried, see below) was that, oftentimes, connected accounts would just stop syncing. Sudden disconnections, sudden failures, weird automation failures, etc. With Monarch, my accounts consistently stay connected, with very rare or sparse interruptions. The automatic categorization works. The app just works.

With the above summarized, let’s dive into specific features.

Budgeting

When I first started using Monarch a year ago, the budget was a tiny bit inflexible and lacked an easy way to track irregular budgets or transactions. For example, maybe you have an annual subscription, or maybe bi-monthly payments for private lessons.

Recently however, Monarch rolled out a new budgeting system where you can split your budget into three categories: Fixed, Flexible, and Non-Monthly.

Fixed budgets are just that - they’re consistent, monthly, and don’t change or fluctuate much. These are easy, and usually, this type of budgeting is supported in many other apps. But the new Flexible and Non-Monthly budgets really make this app awesome.

Non-Monthly budgets will automatically split up an amount across the next 12 months. For example, if your car registration is $480/year, it will automatically allocate $40/mo and roll over each monthly amount. By the time you get to this time next year, the $480 spent will zero it out. It’s a nice way of keeping track of how much each month you should technically be “saving” for these annual or non-monthly budgets.

With Flexible budgets, the amount you spend on multiple categories may fluctuate every month. You can set a general, overarching amount (e.g., $500), and this $500 is free to be allocated however needed across all the categories inside the flex. Maybe last month I bought $200 of whiskey for a friend’s birthday gift, but this month, I’ll spend nothing on alcohol and instead eat out. Flexible budgets allow for this, and won’t scream at you because you’re still only spending the same allocated budget (e.g., $500).

Monarch lets you create as many custom categories as you like and automation rules, which will auto-categorize transactions based on a variety of criterion like amounts, statement descriptions, which account the transaction is for, and more. Budgets are then set for these categories.

You can even configure the rules to categorize things as transfers and automatically hide/exclude transactions from the budget. This is useful for excluding “duplicate” transactions if you’re e.g., just transferring funds from one account to another. This basically allows me to put my finance tracking on autopilot.

Occasionally, I may purchase from new merchants and need to add a new Rule or category to my budget. But this is pretty rare. The net effect of these features:

I can easily spot and be informed of anomalies. For example, I found a few mistaken or unauthorized transactions and was able to dispute them early on because something was wrong in certain categories.

“Huh? How am I $90 over my book budget this month?”

→ “What’s this Amazon purchase?”

→ “Hm. I think my card number has been compromised.”

I would never have noticed this transaction under normal circumstances.

It’s easy to tell exactly how much money I’m spending and saving each month. I’ve seen a lot of commercials for things like “subscription trackers” or other apps that help you reduce runaway spending. But there’s no point in using those when a good budgeting app can already offer that in addition to other features. With custom categories, I know all of the subscriptions I have and how much I’m spending in total.

I invest little time in managing my finances and let Monarch do all the work. I only check Monarch once a month at the end of the month to see where I ended up on all my budgets. Then I adjust for next month.

Investments and Goals

Another neat feature is Goals, which can allow you to track money/savings across many accounts. You can then allocate a part of your budget towards said goals, and this keeps you accountable/informed for making progress each month.

Another neat feature that other budgeting tools I tried didn’t have - Investments, which show you a holistic allocation across all of your investment accounts. Mint had this to a degree, but it sucked and was never accurate.

Monarch, however, has deep integrations with all your accounts, so you can see a true and deep breakdown of your portfolio. Usually, investment apps will give you a breakdown of what’s in that specific account, but Monarch gives you a view across all connected accounts.

I honestly don’t use this page much, but it’s nice to keep tabs on the trends in your portfolios. Incidentally, markets are getting crushed recently because… well, you know.

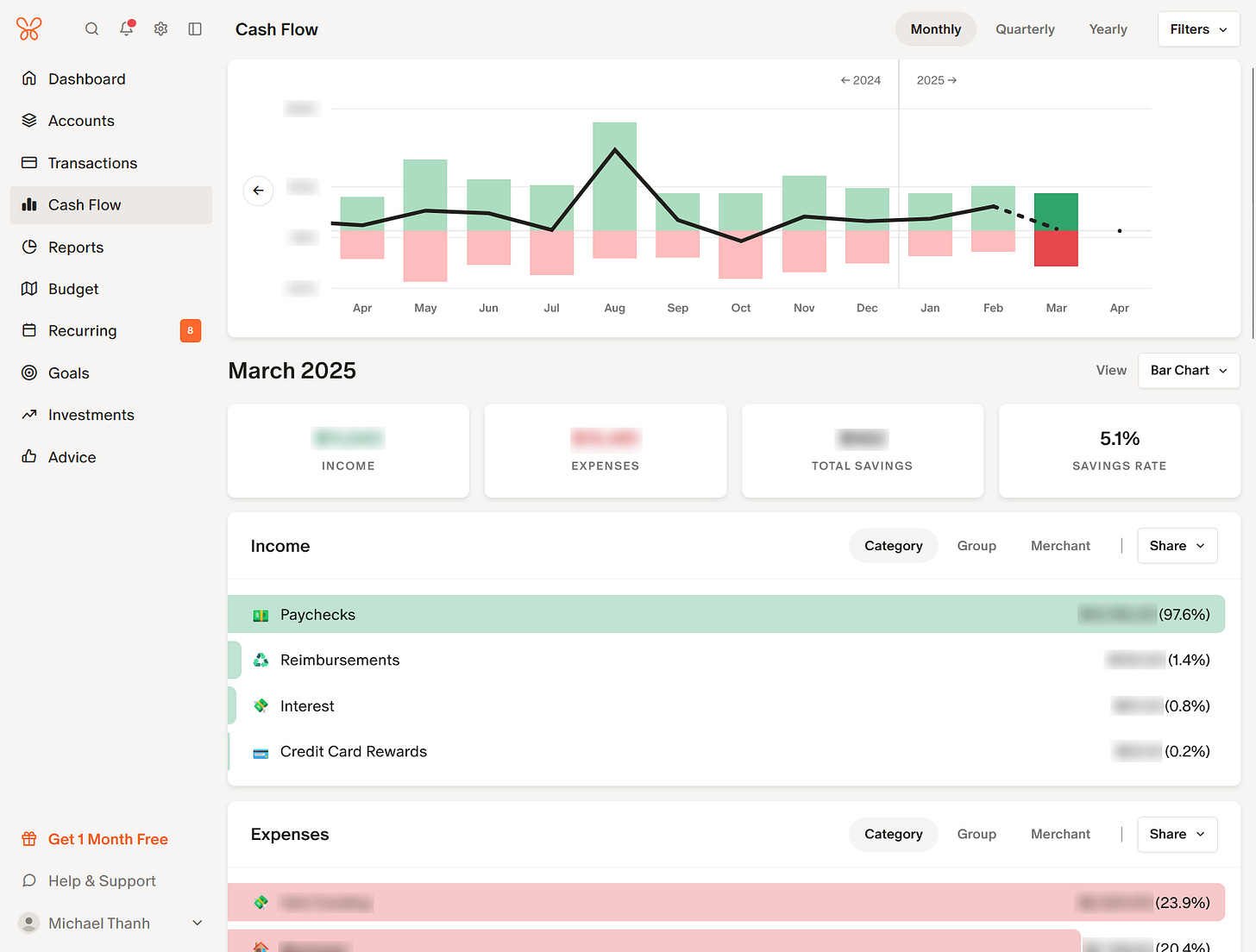

Neat Analytics

The Cash Flow page shows you a breakdown month by month of how much money comes in and out, along with tables below of your largest income categories and expense categories. This page has shown me on numerous occasions that I spend more money on whiskey than I probably should :^)

Also, the graphics and reports are beautiful, nice to look at, and easy to understand. This is important - sometimes budgeting apps will overcomplicate the graphs and analytics. But Monarch folks clearly understand the primary use cases for customers when they look at reports.

You can view most everything: net worth performance/breakdowns, assets vs. liabilities, expenses vs. income, all transactions, etc. I’ve got only great things to say about this app.

Other Features

You can also track assets/liabilities here, like properties, cars, and other types of accounts that aren’t traditional bank or brokerage accounts. All of these will feed into your overall net worth analysis.

There is also the capability to keep track of recurring merchants, transactions, and even bills, though I admittedly don’t make use of these much.

After poking around, it looks like you can add additional household members to also manage the account as well as provide access to Financial Professionals.

Full custom tagging/categorization system, ability to edit merchant and institution information… again, features I don’t use, but could be useful.

Other Tools I Tried

I did try a few other tools last year as well:

Quicken Simplifi - 🤷

This one generally has good reviews, but from what I remember about it, I had some problems integrating with several of my accounts at the time (e.g., Titan, Fundrise, Apple Card, etc.).

I probably could have given this one a better shot; I remember being fine with all of the other features Simplifi offered, and looking at the docs now, the features seem to be up-to-par with Monarch, and screenshots of the app look pretty good. But I’m very happy with Monarch and have no plans to switch anytime soon.

It’s a little bit cheaper than Monarch Money at only $5.99/mo or $72/year (billed annually). Might be worth checking out!

YNAB (You Need a Budget) - 👎

I didn’t like the interface, and it didn’t track investments or have as many features as Monarch did in early 2024.

I also found the zero-based budgeting quite pedantic and annoying, whereas my expenses and budget fluctuate every month. Monarch allows for this nicely.

After reading the reviews at the time, I also noticed that YNAB is generally very slow to innovate and introduce new features.

YNAB is a tiny bit more expensive ($109/year or $9/mo) vs. Monarch Money ($99/year or $8.03), while being, in my opinion, a worse app.

CreditKarma - 👎

I had been a user of CreditKarma since before it was acquired by Intuit. At its heart, it was a “financial score” app that also advertised products like credit cards, loans, and insurance. Intuit tried to retrofit more budgeting features into it, and when they were shutting down Mint, they urged Mint users to switch to CreditKarma.

Holy sh*t, it sucks. It is not an adequate budgeting app by any stretch of the word - no custom categories, no flexible budgets, no rollovers, and it doesn’t support a ton of connections/accounts. Even the reporting and analytics are bad.

Most importantly, it remains a financial score/finance product advertiser first and foremost - you have to tap and scroll a ton to get to the categories/budgeting section. You only have basic categories, and that’s it. It might work for people with very basic needs. And if you don’t want to spend any money on a budgeting app. But I think a good budgeting app is well worth the money spent on it.

NerdWallet - 🤷

I’d also been a user of NerdWallet for a while, but like CreditKarma, the application was primarily focused on content like financial advice, analysis/review of products, etc., before they added in budgeting features.

It’s somewhat better than CreditKarma in terms of features and application interface, but its budgeting and personal finance features are still very basic compared to Simplifi and Monarch Money. Like CK, it’s completely free as they make their money from product referrals and advertisements.

You can track things like spending categories, cash flow, etc., but like CK, you can’t do any custom categories, rollover budgeting, etc. Again, very basic app.

Some other tools I’ve heard about but haven’t actually tried include PocketGuard, CountAbout, and EveryDollar. Feel free to comment below if you have experience with any of these!

Overall Pros & Cons

Pros

Meets the vast majority of use cases. I can’t promise that this app will meet all needs - it won’t track things like asset depreciation, as it’s not a full tax/finance tool. But it will more than suffice for most users.

It just works, and it can connect most finance accounts. You’ll spend some time upfront organizing your categories and rules as needed, but once done, everything just coasts along. It’s also the only budgeting app I tried that works flawlessly with Apple Card…

Gives you a full, deep, and in-depth picture of your finances. Analytics and reports offer tons of visuals for your financial picture, and the organization of transactions and budgets is unparalleled.

Other standard features for the 21st century. Multi-factor authentication, immediate notifications for budget violations, recurring merchants, past bill due dates, etc.

Cross-platform. Mobile apps, iPad apps, and web applications allow you to manage and track your budget pretty much anywhere. On iPhone, there is also a useful widget you can insert that shows all the latest transactions. Very useful for quickly glancing at what’s coming in to your accounts.

Cons

It’s $99.99/year (or $14.99/mo). This isn’t a big deal for some folks, but for others, their finances and transactions may not be complicated enough to justify spending money. In that case, I’d direct you towards NerdWallet.

I’m being honest, I can’t think of any more cons. Maybe others will have some, but I’m very happy with this app. It’s far better than Mint was, and I don’t at all mind paying for it.

Hopefully, you’ve found this review helpful - if you’re looking for a new budgeting app and $100/year or $15/mo isn’t a big deal for you, I highly encourage you to check it out.

Thank you for reading App of the Month. Hope you enjoyed this month’s edition! Leave comments or questions below. If you have specific feedback, let me know in this form.

If you find these app recommendations useful and helpful, subscribe to the free newsletter for continual updates and share with your friends!